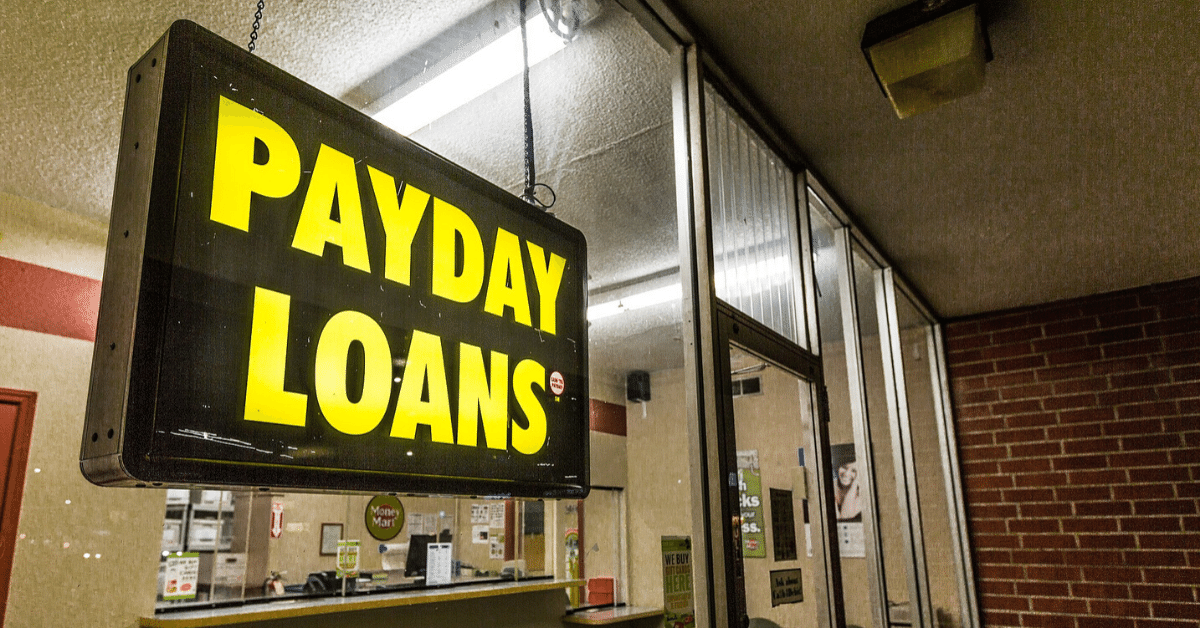

Calgary is a city with a booming economy as well as lively culture where residents frequently encounter financial emergencies or unexpected expenses. For a lot of Calgarians, the demand for immediate money is a necessity – whether it is for an automobile repair, a healthcare bill or electricity bill. In such circumstances, payday loans have emerged as a popular remedy, providing fast as well as convenient access to emergency money with very little hassles. Payday loans are being praised by some Calgary residents for their ability, accessibility, and convenience to offer help in times of need. Continue reading “Calgary Residents Rave About Quick Cash with Payday Loans!”

Calgary is a city with a booming economy as well as lively culture where residents frequently encounter financial emergencies or unexpected expenses. For a lot of Calgarians, the demand for immediate money is a necessity – whether it is for an automobile repair, a healthcare bill or electricity bill. In such circumstances, payday loans have emerged as a popular remedy, providing fast as well as convenient access to emergency money with very little hassles. Payday loans are being praised by some Calgary residents for their ability, accessibility, and convenience to offer help in times of need. Continue reading “Calgary Residents Rave About Quick Cash with Payday Loans!”